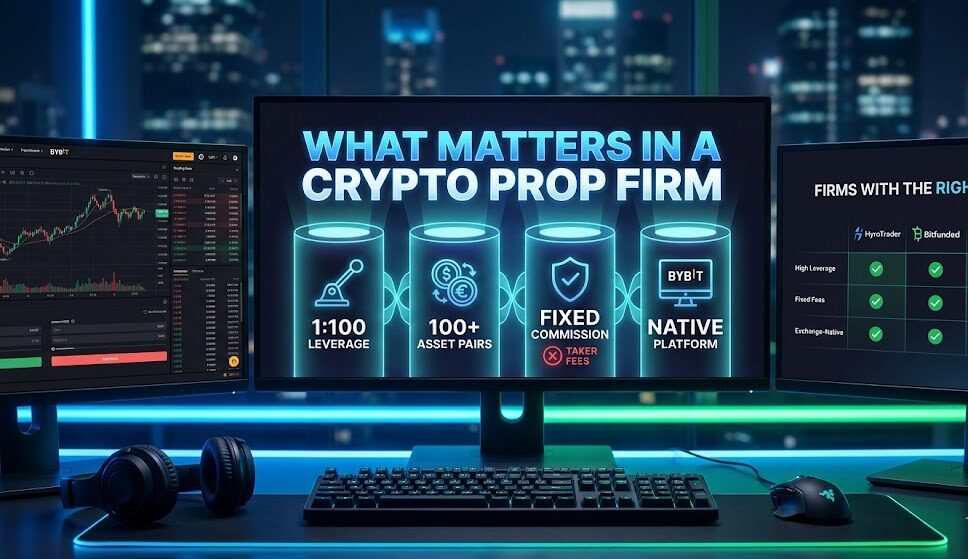

The crypto prop space is often cluttered with Forex firms trying to pivot. For a serious trader, a firm is only as good as its trading conditions. If you are looking for a platform that respects the volatility of the digital asset market, these four pillars are the minimum requirements.

1. High Leverage (1:50+)

Most traditional prop firms offer 1:2 or 1:5 leverage on crypto. While this works for long-term swing trading, it is insufficient for intraday crypto traders. To maximize capital efficiency on a funded account, you need a minimum of 1:50 leverage on Bitcoin and Ethereum. Firms like HyroTrader and Bitfunded have set the bar here, offering the high-leverage (1:100) environment crypto traders need to scale positions properly without hitting margin limits prematurely.

2. Asset Depth Beyond the Top 2 or 3 (BTC,ETH, SOL)

Crypto trading is about catching the “narrative.” If a firm only offers BTC, ETH, and SOL, you are missing out on the volatility found in mid-cap tokens and ALT Coins. A competitive firm should provide access to at least 50-100+ altcoin pairs. This ensures you can trade the assets that actually have the volume and movement on any given day.

3. Fee Efficiency: Maker/Taker Models

While a 0.1% fee sounds small, if you are trading $100,000 of position size on a $10,000 account (10x leverage), that fee is $100 just to open and another $100 to close. That’s $200 gone instantly—2% of your total account balance—just in fees.

4. Platform Preference: Exchange-Native Tools

While MT5 is a powerhouse for execution speed and automation, most crypto traders have spent years mastering exchange-native interfaces. Platforms like Bybit offer specific features—such as coin-margined contracts, advanced cross-margin settings, and deep order book visibility—that MT5 lacks. A firm that provides an API connection to an actual exchange interface usually offers a smoother transition for native crypto traders.

5. Reputation and Reliability

In an industry where longevity is rare, choosing a firm with a proven track record is essential. You want to see a history of consistent payouts and transparent rules. FXIFY, for instance, has gained a strong reputation by offering dedicated crypto plans with instant funding options and 1-step evaluations specifically designed for crypto volatility. Their focus on customizability and “on-demand” payouts makes them a top choice for traders who value speed and reliability.

Summary

The industry is moving toward specialization. To find the best crypto prop firms, you must look past the marketing and evaluate the leverage, the pair availability, and whether the fee structure allows for high-frequency or high-volatility strategies.