Date: December 26, 2025

Subject: Collapse FX vs. QT Funded (Quant Tekel)

Verdict: Payout secured via public pressure, not standard support.

Truth Score Update: QT Funded Deduction

Following the Collapse FX incident, we have applied a strategic deduction to QT Funded’s Truth Score. While the payout was eventually processed, the fact that a resolution was only reached after public escalation on social media points to a significant failure in the firm’s internal support and compliance protocols. At Funded Truth, we believe a firm’s reliability should be measured by its standard automated processes, not its response to PR pressure. This “payment-by-outcry” pattern creates an uneven playing field for traders without a social media following and suggests a lack of transparency in how rules are applied. Until QT Funded demonstrates a consistent, private resolution path for all traders, their score will remain suppressed to reflect this operational risk.

1. The Conflict: Silence from Support

The incident began when Collapse FX followed standard protocol for a payout request. Despite meeting the trading requirements, the payout was initially stalled or denied by QT Funded. For many traders, this is where the story ends—lost in the “support ticket void.”

2. The Catalyst: The “Public Pressure” Meta

Recognizing that private appeals were failing, the trader shifted tactics. By tagging QT Funded and industry watchdogs like Prop Fund Squad in a public post on X, Collapse FX turned a private dispute into a public PR liability.

The result was immediate:

- The community rallied, questioning QT Funded’s liquidity and ethics.

- The post gained hundreds of impressions within the “Prop Twitter” circle.

- The firm’s reputation—their most valuable customer acquisition tool—was directly threatened.

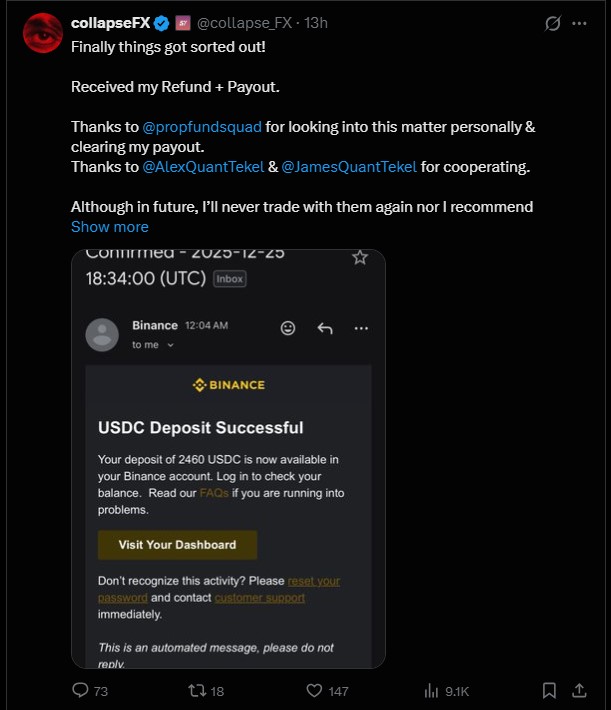

3. The Resolution: Payment for Deletion?

In a move that has become a “meta” in the prop space, the payout was processed almost immediately following the viral traction. Once the funds were received, the trader deleted the evidence.

Watchdog Note: This “Resolution-then-Deletion” cycle is dangerous for the community. It solves the problem for the individual trader but hides the firm’s initial failure from future customers. It proves that visibility, not just profitability, is a requirement for payouts at certain firms.

4. Critical Analysis for Funded Truth

This case study proves three uncomfortable truths about the current state of QT Funded:

- Support Inequality: High-profile traders or those with a “voice” on social media receive preferential treatment in disputes.

- Opacity in Rules: The firm likely used a “soft breach” or technicality to deny the payout initially, only “waiving” it when the public backlash became too expensive.

- The Survival of the Loudest: Traders without a social media following are at a significant disadvantage if their payout is flagged.

5. Final Verdict for Traders

While the trader was paid, the process was flawed. If a firm requires a Twitter “riot” to honor a contract, they are signaling a lack of operational maturity or liquidity issues.

Trader Advice:

- Always record your “Payout Request” screen.

- If support ignores you for >48 hours, go public.

- Tag Funded Truth and other watchdogs to ensure your voice is heard.

| Source | Evidence Type | Status |

| @collapse_FX | Public Accusation | Deleted (Resolved) |

| @propfundsquad | Community Alert | Active |

| Support Logs | Trader Testimony | Verified |